Quick-books are accounting software designed for small & medium-sized businesses.

Quick-books products are geared mainly toward small and medium-sized businesses and offer on-premises accounting applications as well as cloud-based versions that accept business payments, manage and pay bills, and payroll functions.

Rentrax helps you to export the invoices, Customer information, and payment information either manually or automatically into your Quick books account.

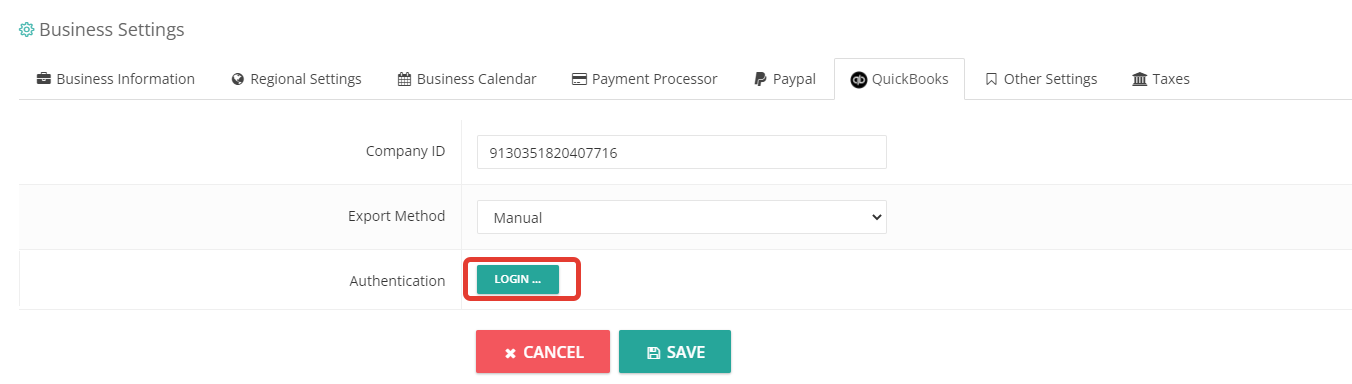

Go to Location settings and click on the "Quickbooks" tab.

1, Company ID: Use the link below to log in to your Quickbooks account.

URL: https://app.qbo.intuit.com/

Once login, click on the Settings gear on your top right and select "Account & settings" and click on billing & subscription and copy your company ID.

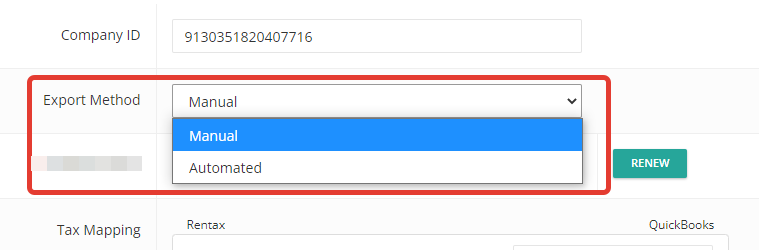

2, Export Method: Select the export method manual or automated to export the invoices, Customer information, and payment information into your Quick books account.

3, Authentication: Click on the "Login" button to get the access token from your QuickBooks account. Once the token is expired, you may be able to renew it again.

4, Tax Mapping: Map the Rentrax taxes with Quickbooks taxes

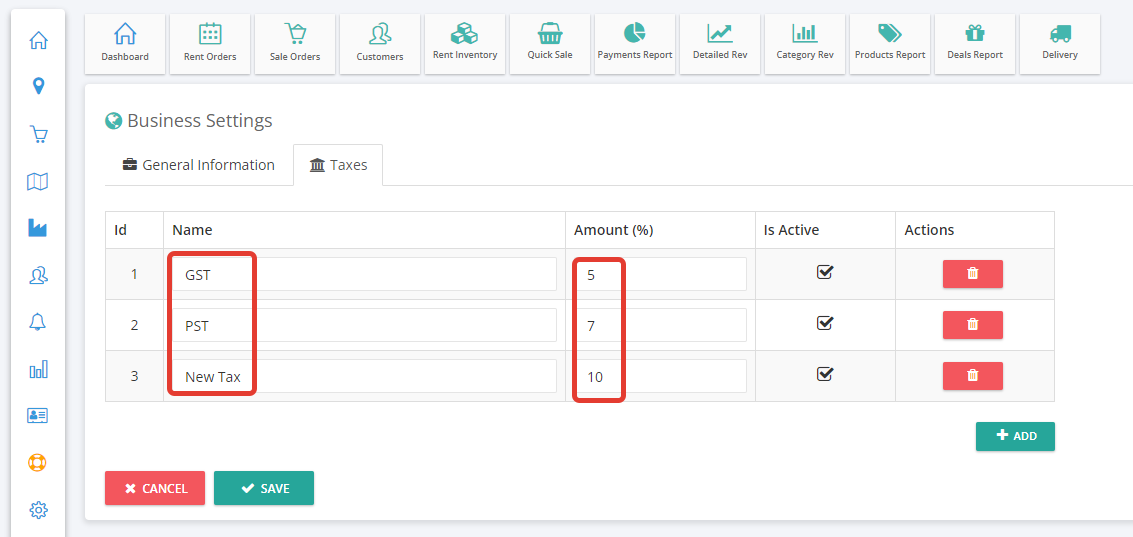

Make sure you defined your taxes in Rentrax first. You may be able to define the taxes individually or combine both the taxes and define them as one group.

Now, define your taxes in QB.

NOTE: Maybe the interface varies from QB app to app.

Generally, when you are subscribing with QB based on the state the default taxes are going to be added to your account. If not, follow the instructions below

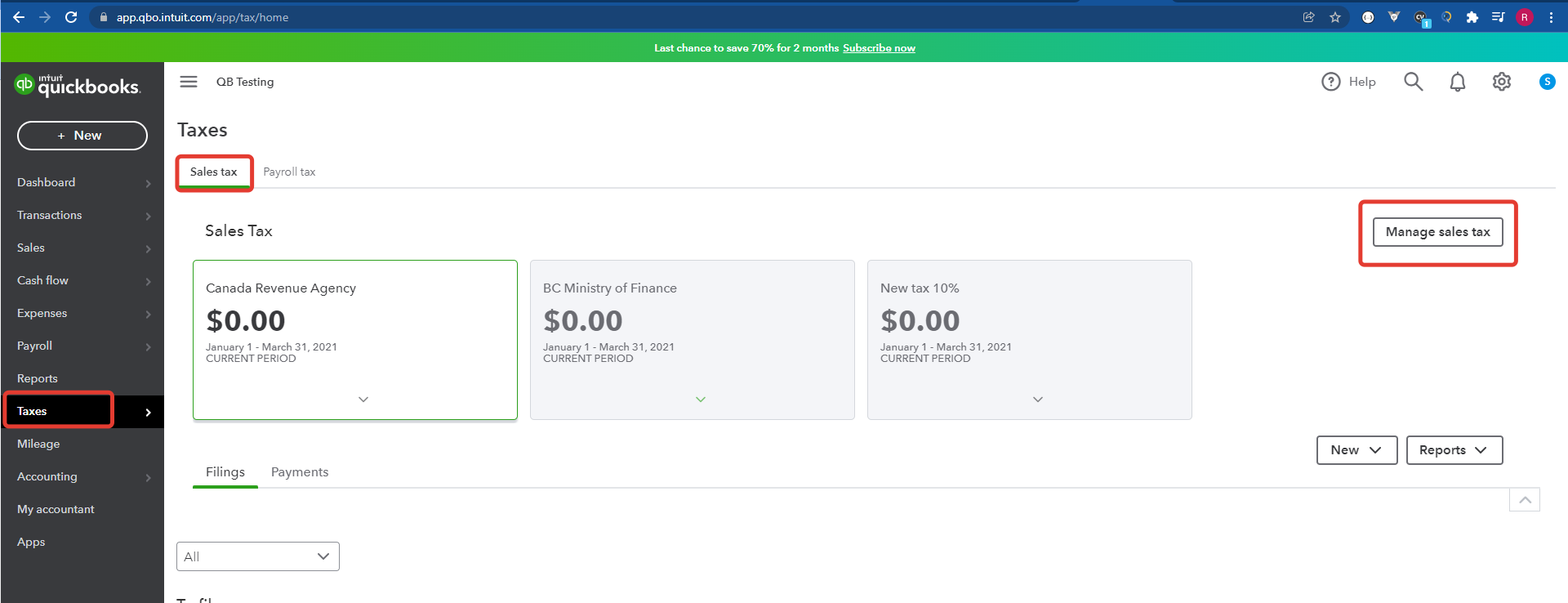

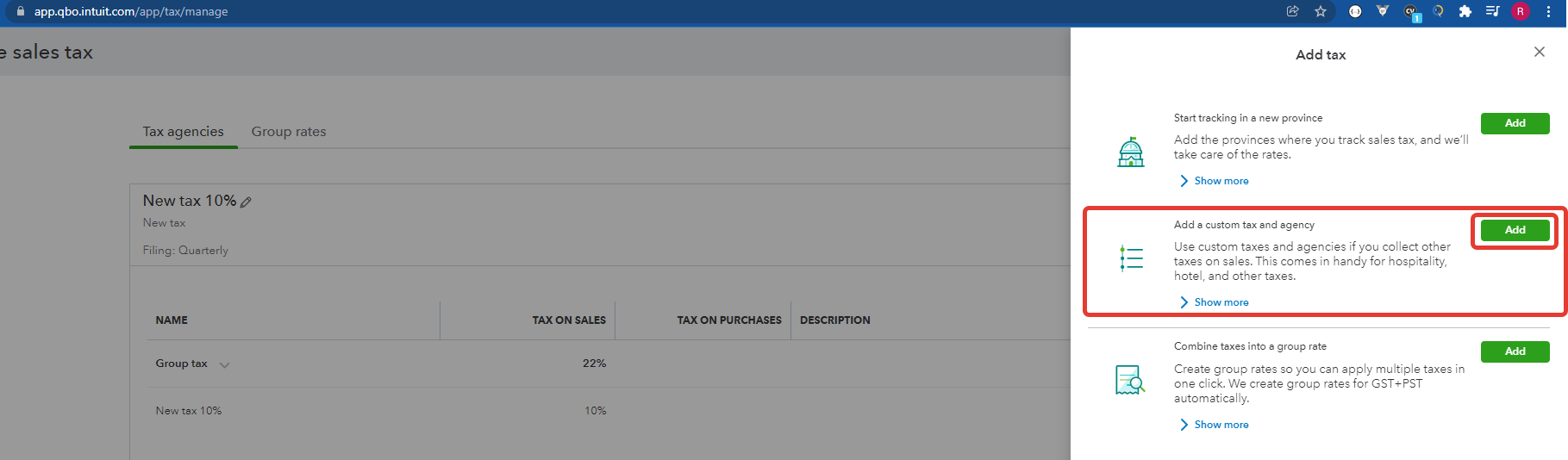

After login into your QB account, click on the taxes and select sales tax. Click on the "Manage sales tax" in order to define the taxes individually.

Here click on the "Add tax" button and click on "Add" to create a custom tax individually.

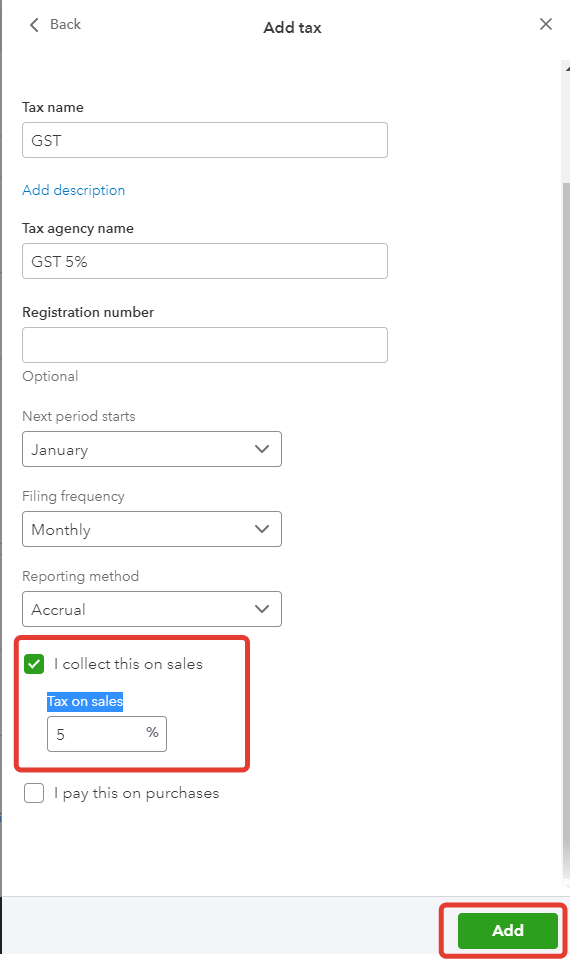

Enter the tax name(internal purpose), tax agency name, and enter the percentage of tax in the box and click on add button.

Use the same procedure to add the other taxes.

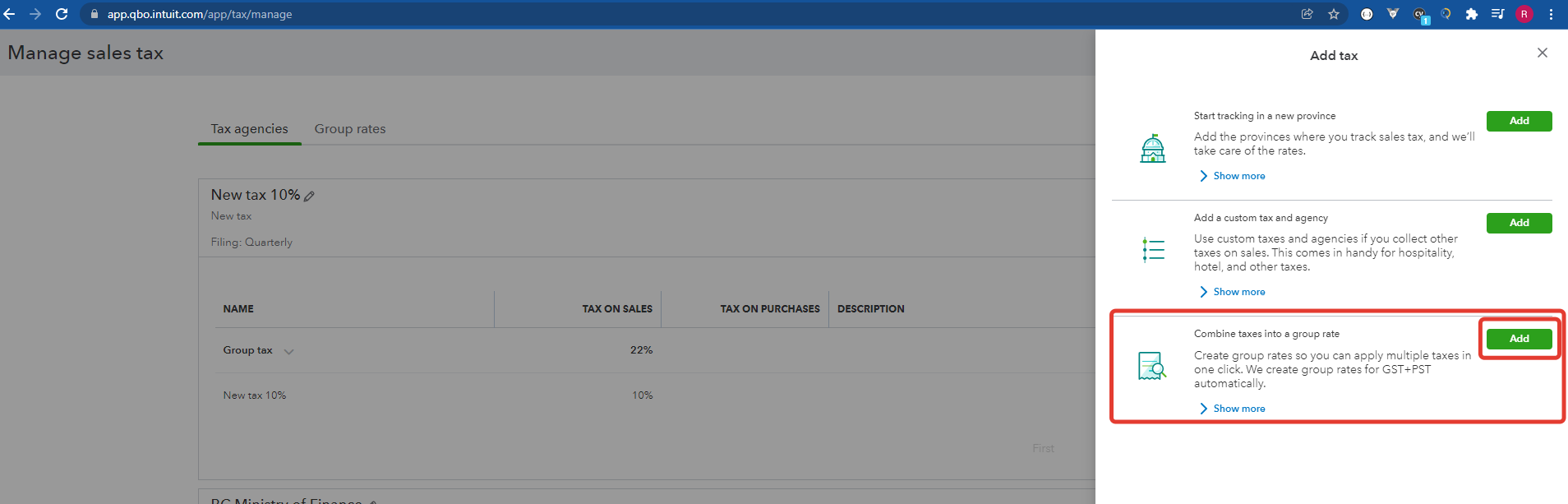

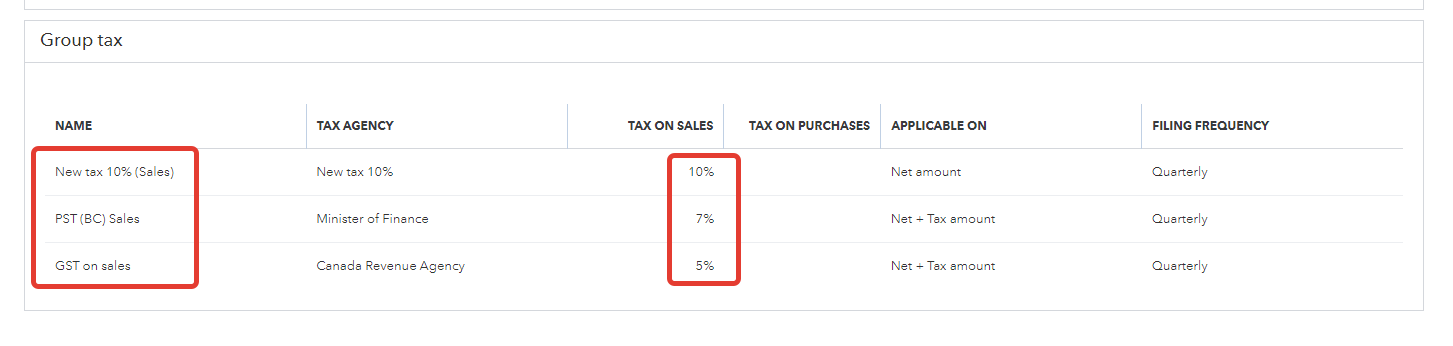

Once the individual taxes are defined separately into the QB pull those individual taxes into a group tax.

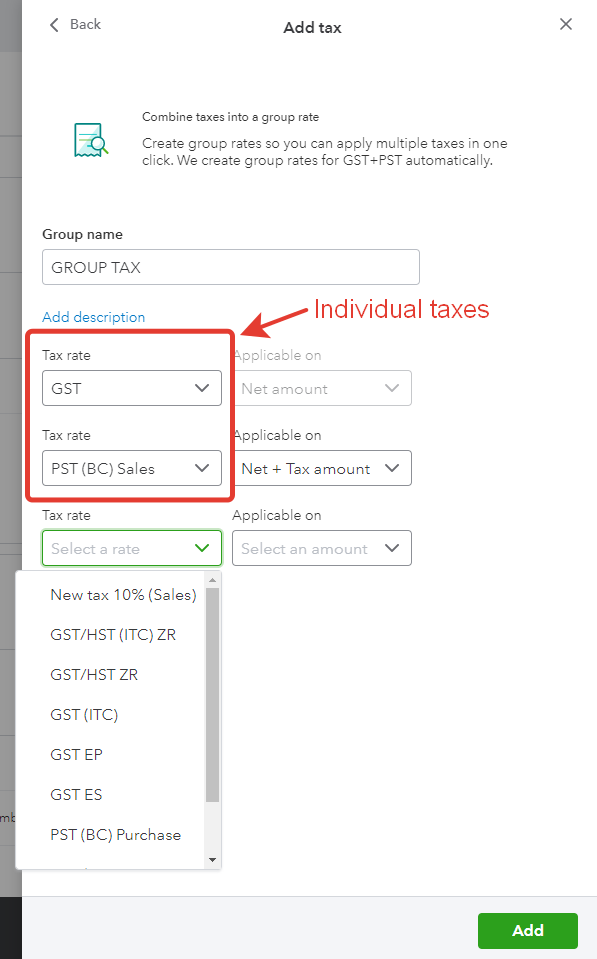

Click on the dropdown and select the defined individual taxes into the group tax.

Here is my three individual taxes pulled under a group tax.

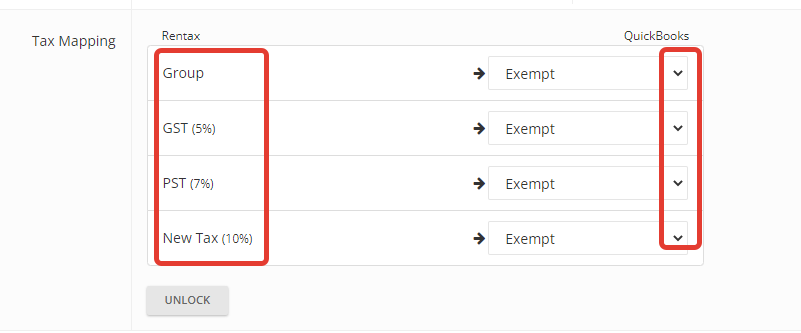

Once the taxes setup is done. Go to your Rentrax point of rental and click on the "Unlock" button in order to load the taxes from QuickBooks.

Use the drop-down button and map the QB tax with Rentrax taxes.

Click on Save.